Here are Some Frequently Asked Questions About the Cruise Industry in Alaska

Q. Will the cruise industry continue its double-digit growth?

A. Moving into 2026, cruise ship passenger numbers are expected to be slightly smaller than the 2023 and 2024 seasons. This is due to three significant agreements between local communities and the larger cruise industry:

1) 5-Ship Limit: In 2024, Juneau started enforcing a 5-ship-per-day limit, a recommendation of the community’s Visitor Industry Task Force, and agreed to by the industry.

2) Daily Caps: Juneau worked with the cruise lines to set a daily agreed upon limit of16,000 on weekdays and 12,000 on weekends, which will be enacted in 2026.

3) Shorter Season: Also in 2026, the cruise season will be significantly shorter. Instead of starting in early April, the 2026 cruise season is currently slated to begin on April 28, and instead of running through the end of October, the season will end on October 6.

These three changes are intended to cap significant overall cruise passenger growth and includes an agreement to meet annually to balance the schedule.

Q. How did the loss of the entire 2020 cruise season and greatly reduced 2021 season impact Alaska?

A. Alaska lost $3.3 billion in lost revenues, taxes and jobs, according to the state. Small business revenue statewide fell 12% as compared to pre-COVID and many shut down, often permanently. While the loss of the ships hit Southeast the worst, it impacted the rest of the state.

Q. How much do cruise lines pay to state and local governments?

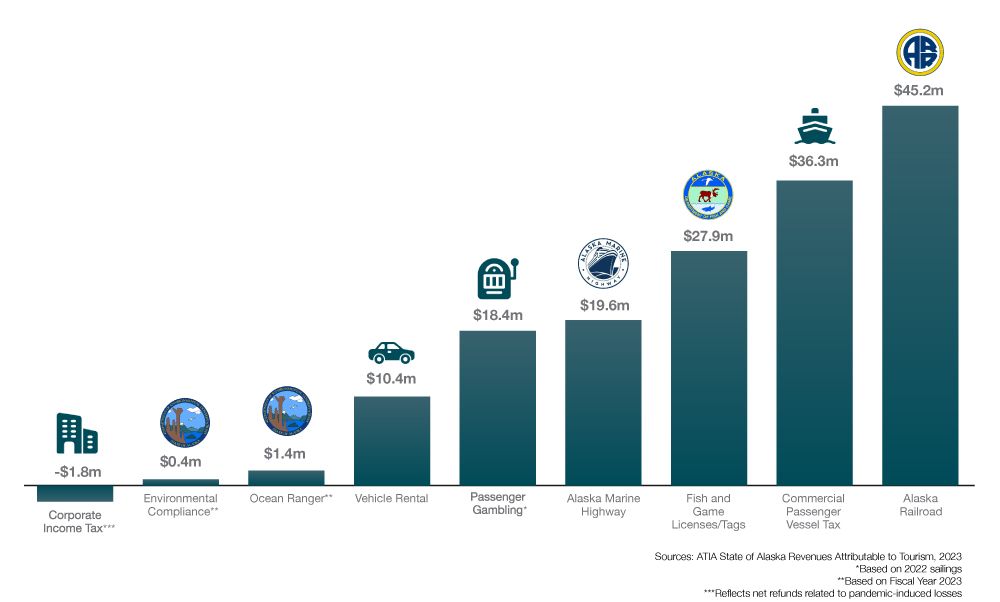

A. $121.8 million in taxes and fees. This includes a $34.50 passenger fee that is shared with local ports. Other state revenues include environmental fees, corporate income tax and a casino tax. Many municipalities collect sales tax and property tax, along with bed and vehicle rental taxes.

State Collects Revenue from Visitors in Many Ways

Total:$198.8 million

Cruise line payments: $40.2 million*

Q. How is the commercial passenger vessel (CPV) excise tax shared with the state and port committee?

A. CPV excise tax revenue is shared with the first seven port communities a ship visits. If a port city is in an organized borough, the city and borough each receive $2.50. Since FY2013, 18 municipalities have shared in $176,192,064 of CPV taxes. In addition to shared CPV revenue, it is not uncommon for the Alaska State Legislature to appropriate additional funds for cruise vessel related grants.

Q. Why can’t we tax cruise passengers to fund state government?

A. The U.S. Constitution, through the Commerce and Tonnage clauses, restricts the use of passenger taxes to services that are directly connected to the passenger and vessel. These restrictions allow residents and goods to flow freely from state to state without onerous local taxation. Imagine what a cross-country trip would cost if you had to pay a new tax every time you crossed a state line. The Tonnage clause restricts the states from imposing taxes on any shipment of cargo without the consent of Congress. Taxing passengers to pay for services available to all citizens is considered restrictive of interstate commerce. In a recent court decision, a federal judge ruled that the per-passenger cruise ship fees levied can only be spent on projects that directly benefit the ships.